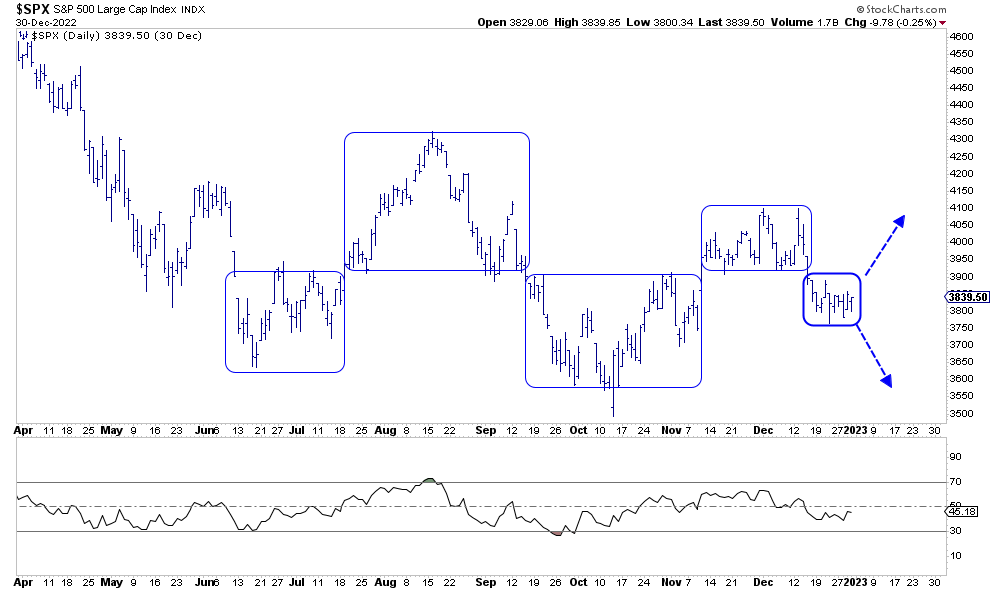

Let’s start our market analysis with the narrow range the S&P has traded the last 10 sessions. We have gone from an up channel trend that started at the Otober 13 low which then sharply reversed on December 13th, the day of the CPI report. This can be viewed well on the 10K tick chart.

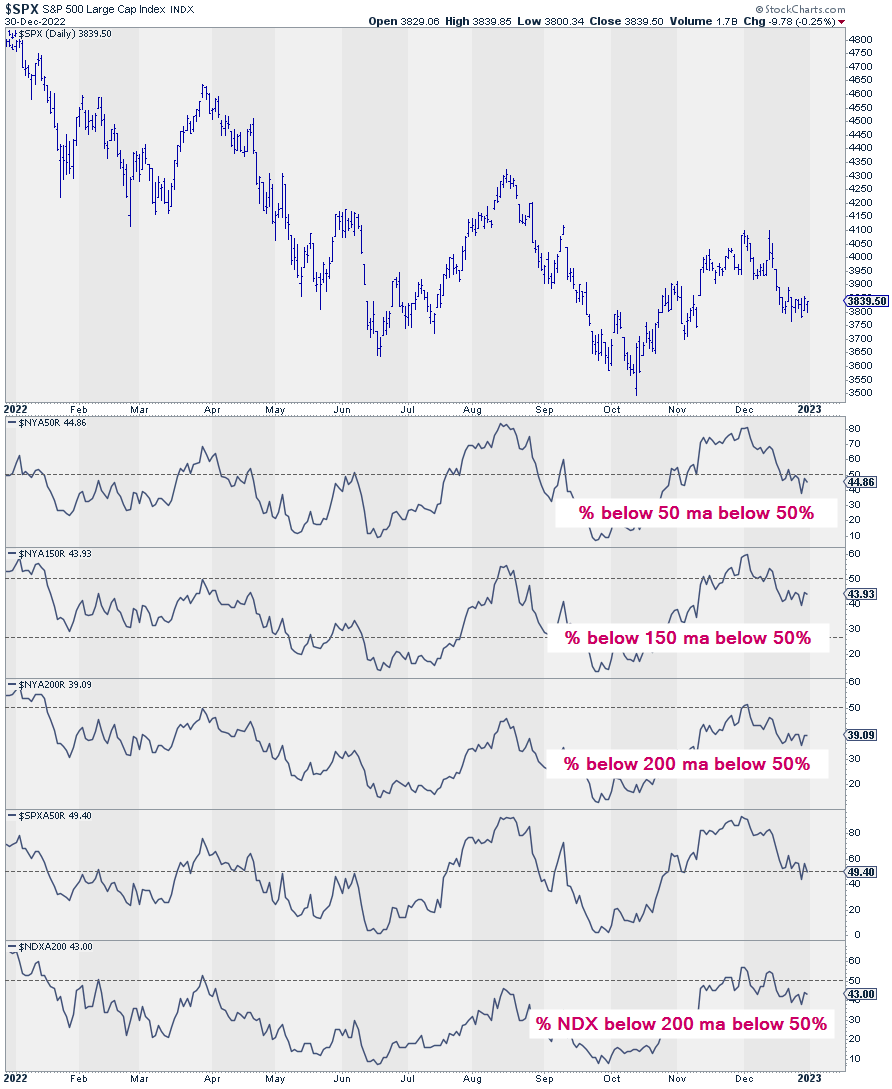

Breadth-wise, over half of all stocks reside below all major moving averages. This is not a healthy sign. We will need to see the percent of stocks move back and stay above the 50% line to have better success catching long swings.

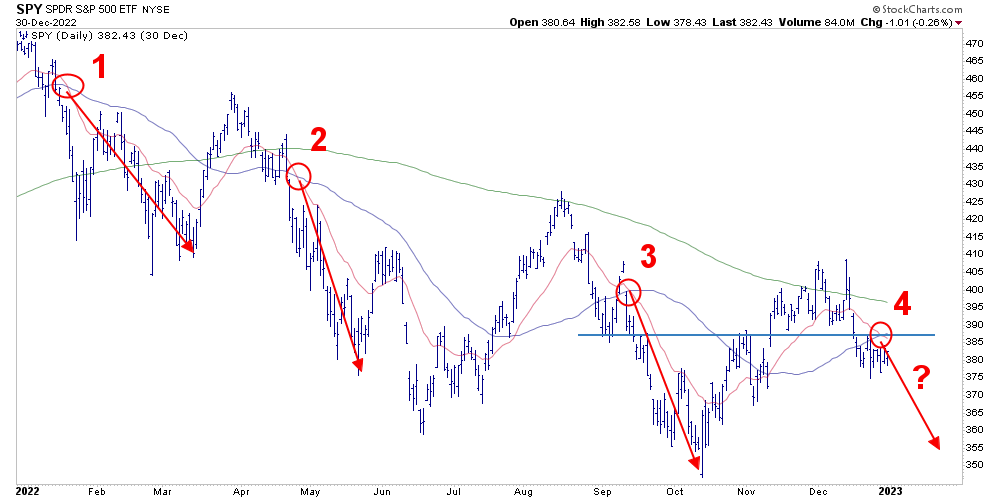

Now if we look at the daily chart we see bearish cross of the 20 ema and 50 sma. This has occurred three other times in 2022 which led to subsequent steep declines. If this plays out again, a measured move would put the S&P below the October low and close to the 50% retrace from the Covid low at the 3460 level.

However, as we know anything can happen and since contraction leads to expansion, it would be wise to expect a break out this week of the current volatility box. Since 2022 has all but killed break out trades, I’ll watch closely for potential look above or below failures. False over reactions up or down often lead to over reactions in the opposite direction.

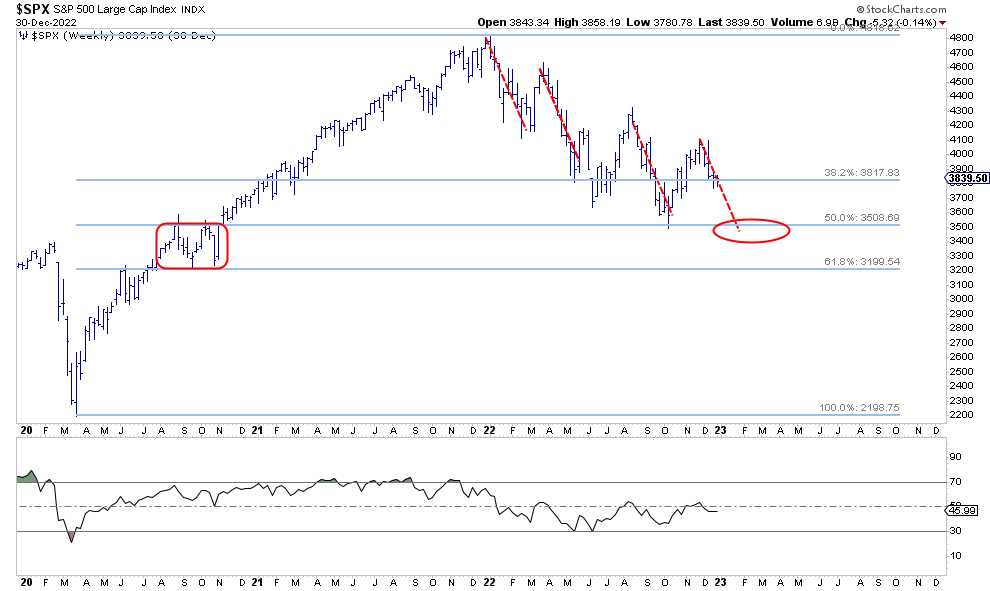

The weekly chart clearly shows the battle of the down trend line. Sellers have come in strong at these points that resulted in significant pullbacks. Since we are holding the 50% retrace from the latest pullback there is potential we can test the downtrend line again. A move below 3775 (61.8% Fib break) and all bets are off.

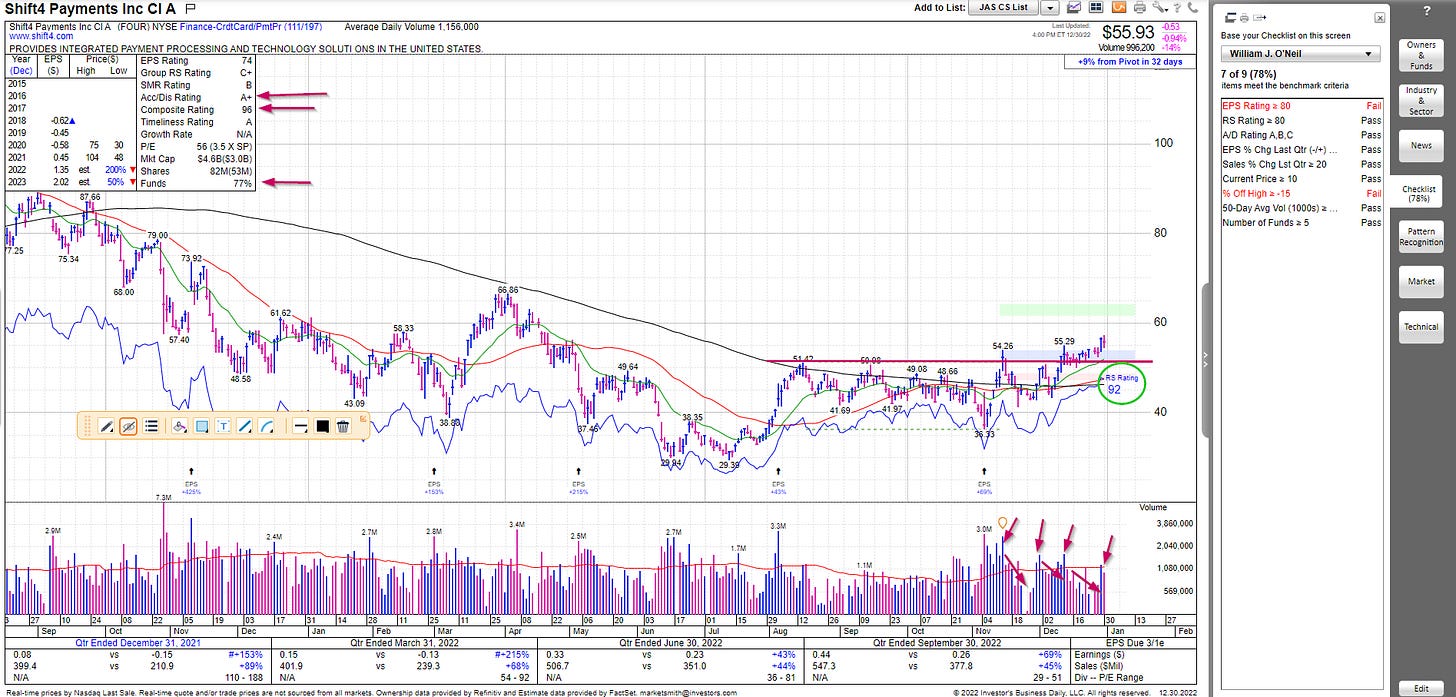

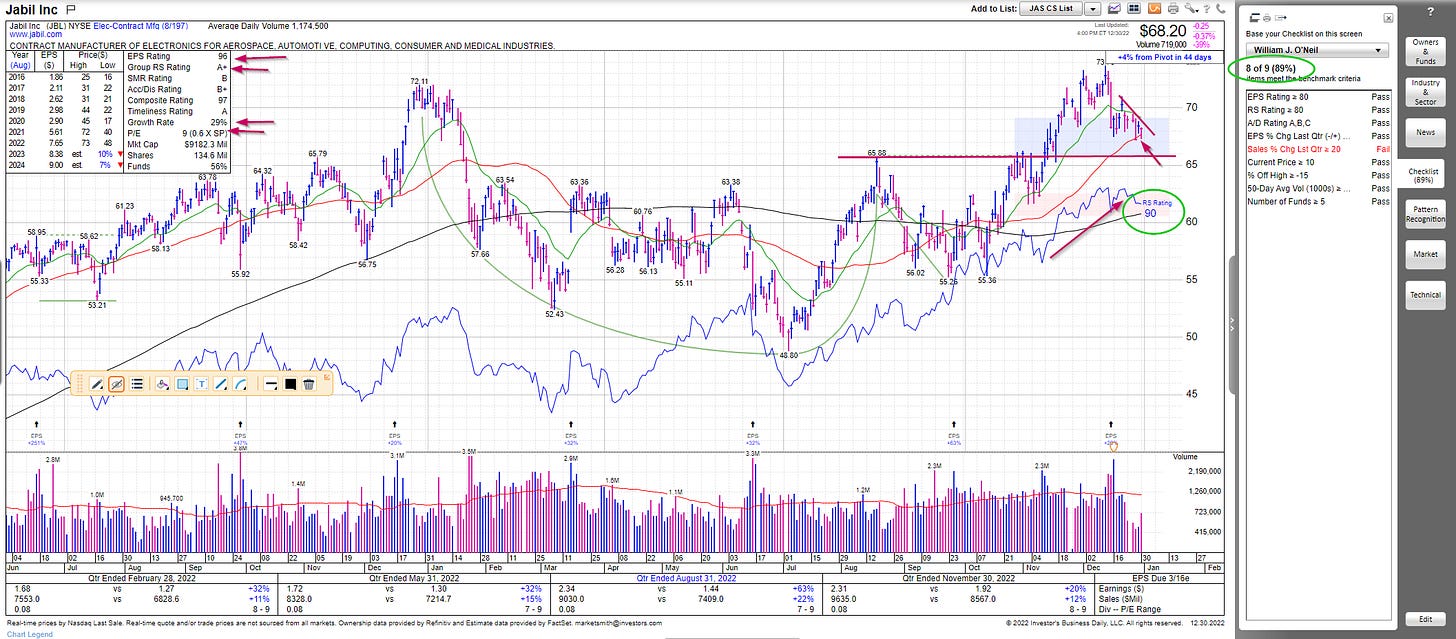

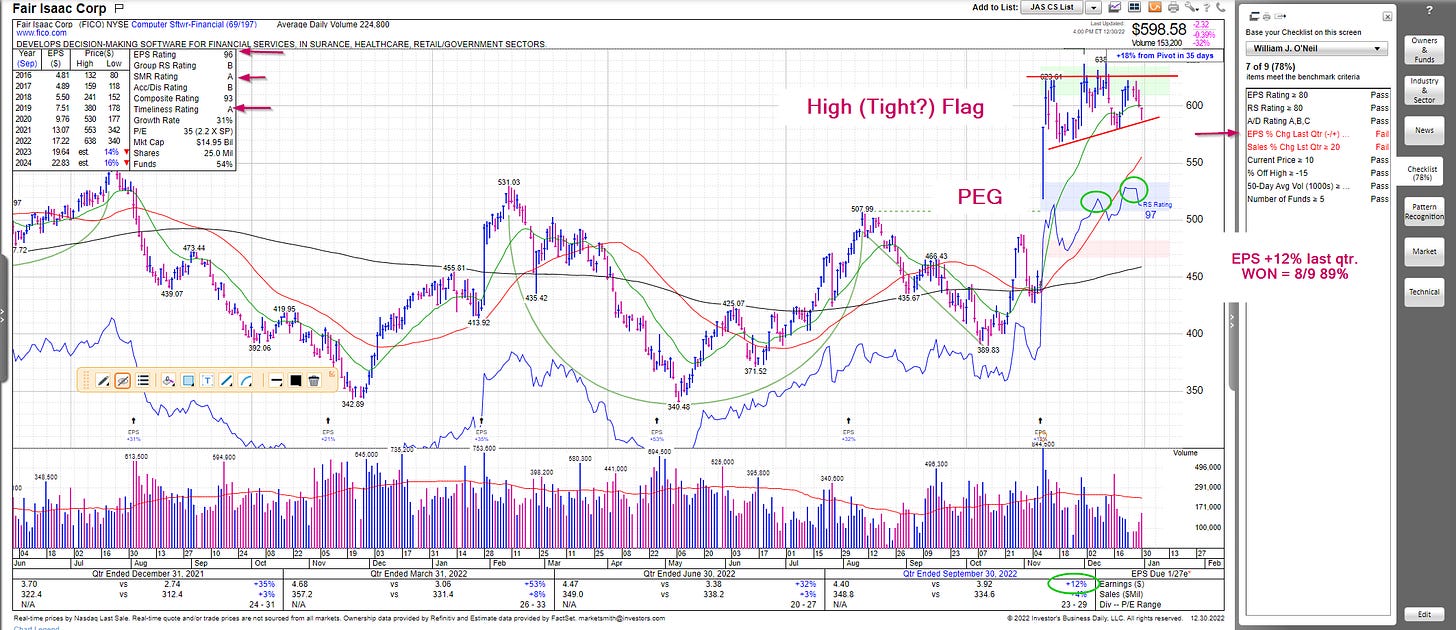

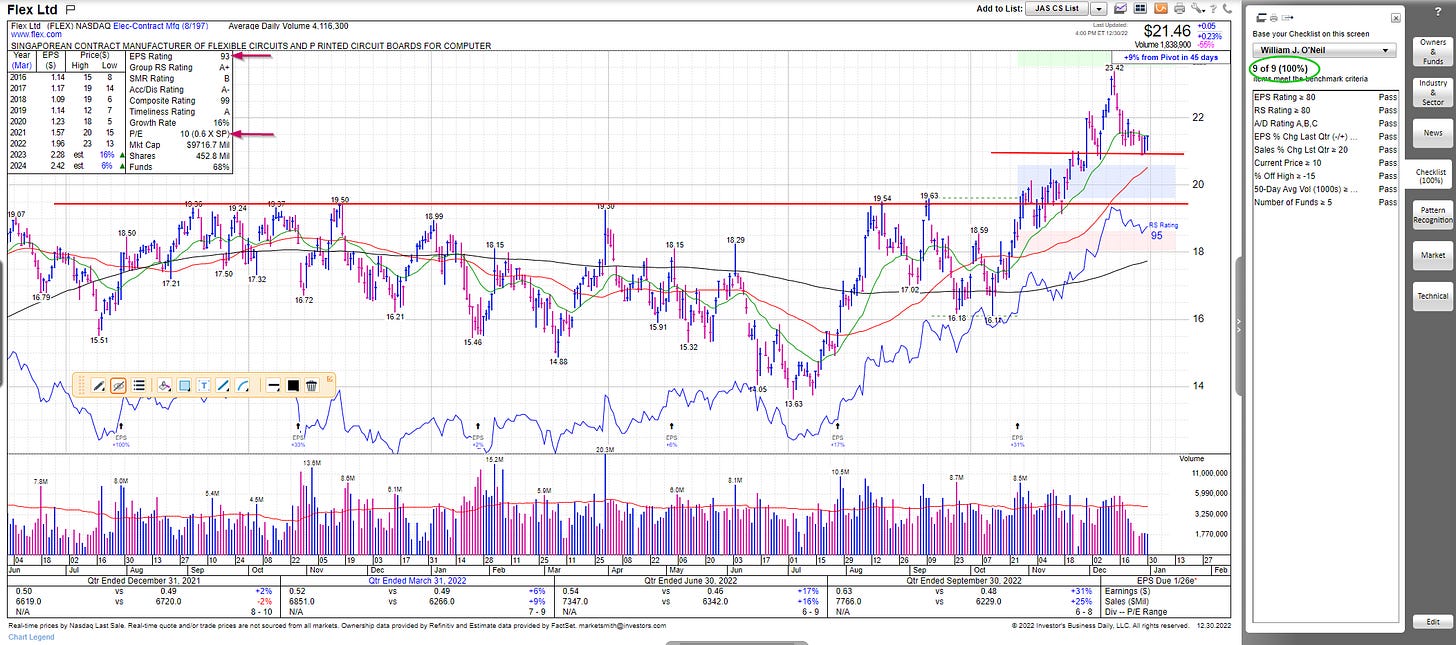

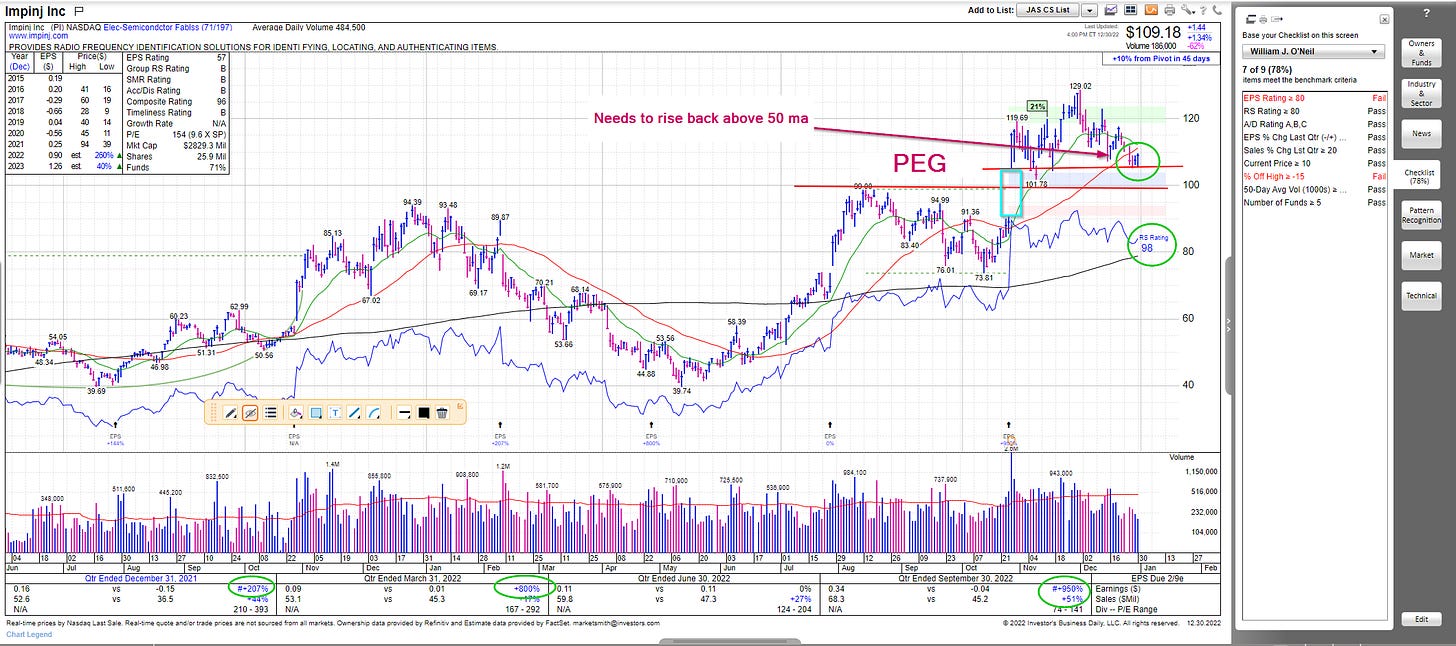

Although I will take an occasional flyer on a beaten down tech name, an example would be buying TSLA 0.00%↑ in the after hours last week at 106.90, my focus mainly will be relative strength stocks trending up that have consolidation/continuation patterns. These setups may be few and far between, but there will be opportunities for those that are patient. The question for 2023 is whether to enter on breakouts (a disaster in 2022) or buy on pullbacks. I think the answer lies somewhere in between.

I will also continue to use my trend following system. I trade this using a basket of sector ETF’s as well as futures. This way I can take advantage of any down trending situations.

Here are some interesting stocks that have turned up in my scans that have compelling setups to watch:

I think the key for 2023 will continue to be patient and extremely nimble. Watch for breakout failures and be willing to reverse a position and go short if the case warrants it.

Here’s to success and prosperity in 2023!

-Jim